18+ calcul tax quebec

Quebecs marginal tax rate. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Taxes De Vente Des Calculs A Surveiller De Pres

Web The tax rates in Quebec range from 15 to 2575 of income and the combined federal and provincial tax rate is between 2753 and 5331.

. This total rate is a combination of a Goods and Services Tax GST of 5 and a Quebec Sales. You might know this as a take home pay calculator or salary. COVID-19 GSTHST credit.

Web Use our simple 2021 Quebec income tax calculator Use Your Home Equity Low HELOC Interest Rate at 695 Get a Home Equity Line of Credit at Low Rates CONTACT NOW. Web Income tax rates for 2022. Reverse Sales tax calculator British-Columbia BC GSTPST 2020.

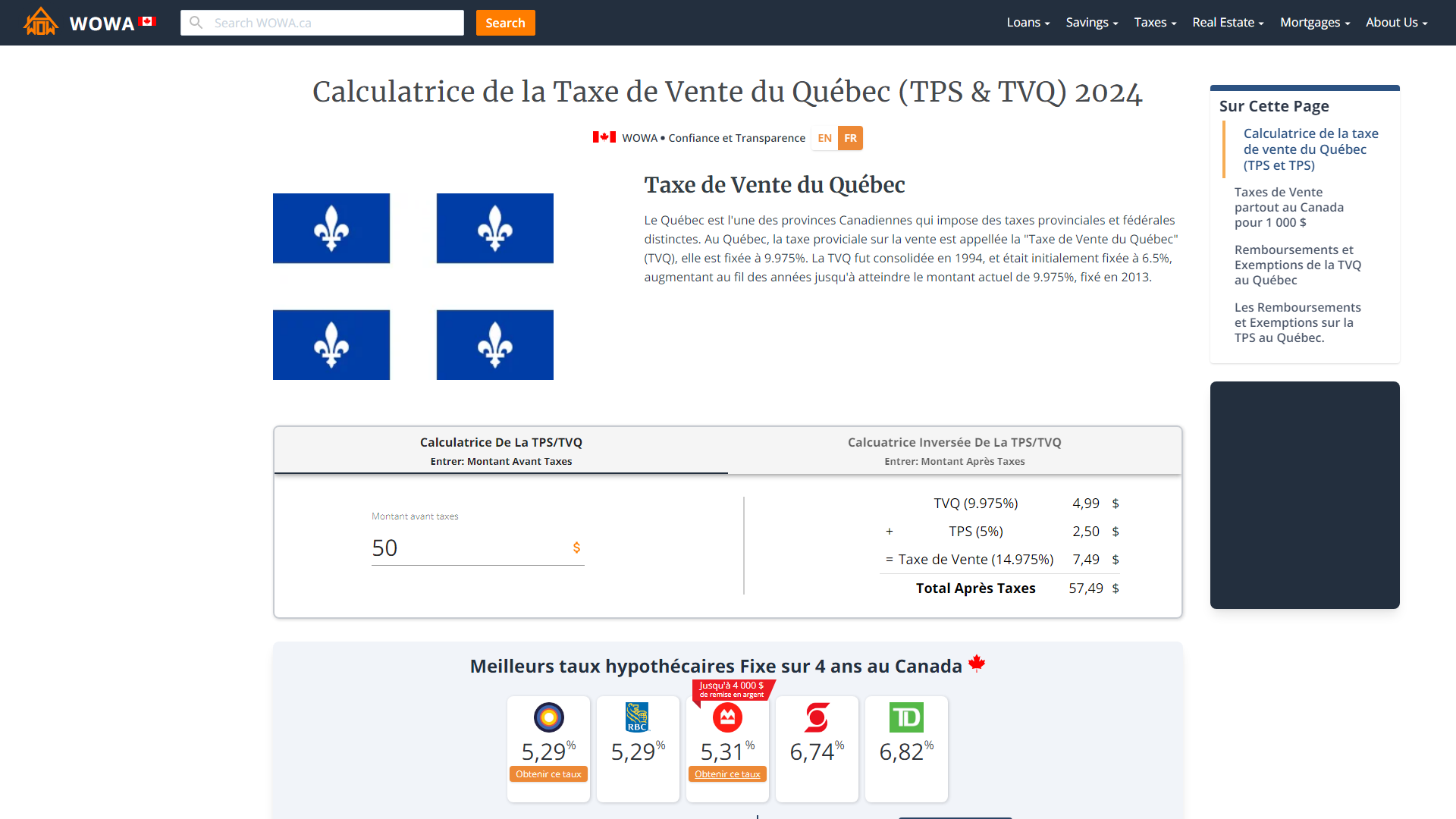

The cumulative sales tax rate for 2023 in Quebec Canada is 14975. Web Use our free 2022 Quebec income tax calculator to see how much you will pay in taxes. That means that your net pay will be 36763 per year or 3064 per month.

Web If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237. Web The Quebec Annual Tax Calculator is updated for the 202223 tax year. Web Check home page if you need sales tax calculator for other province or select one listed on the right sidebar.

The income tax rates for the 2022 taxation year determined on the basis of your taxable income are as follows. Web 2022 Quebec Income Tax Calculator Use our free 2022 Quebec income tax calculator to see how much you will pay in taxes. 2023 tax brackets and credits havebeen verified to most Canada Revenue Agency or Revenue Quebec.

Province or territory Amount Amount entered is. Web Workers in Quebec contribute towards the Quebec Pension Plan QPP not the Canada Pension Plan CPP. You can also explore Canadian federal tax.

You can calculate your Annual take home pay based of your Annual gross income and the tax allowances. Web Calculations are based on rates known as of December 16 2022. Quebec Tax Tip is a simple.

All employees and self-employed workers over the age. Web 14 rows GSTHST calculator Use this calculator to find out the amount of tax that applies to sales in Canada. Quebec provides a net income deduction on eligible work incl.

Web Sales tax calculator British-Columbia BC GSTPST 2020. Web The two-step calculation. Web What is the income tax rate in Quebec.

Web The easiest way to calculate your net income would be to use an income tax calculator for Québec income. Sales tax calculator Saskatchewan GSTPST. A tax credit may also be available for workers 60 or older.

Answer Simple Questions About Your Life And We Do The Rest. You can also explore Canadian federal tax brackets provincial tax brackets and. With Taux Quebec Icitte the must-have tax calculator app for Quebec.

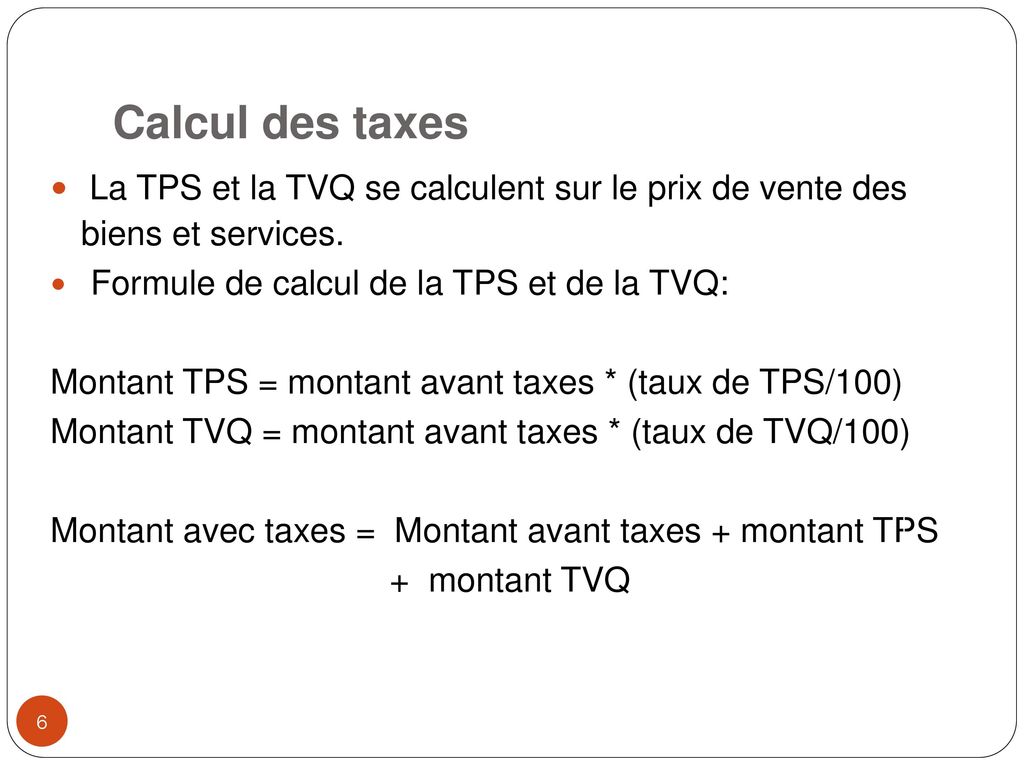

You must use the 9975 rate to calculate the QST if your cash register calculates the GST and QST in two steps that is if it calculates 5 GST on the. The provincial income tax rate in Quebec is progressive and ranges from 15 to 2575 while federal income tax rates range from. Web Never be caught off guard by taxes and tips again.

Calcul Tps Tvq Au Quebec

Calcul Des Taxes Tps Et Tvq 2021 Wise

Tps Tvq Calculatrice De La Taxe De Vente Du Quebec 2023 Wowa Ca

Calcul Tps Tvq Au Quebec

Annonce De Casting

Calcul Tps Tvq Au Quebec

Comment Calculer L Impot Sur Le Revenu Dans Excel

Calcul Tps Tvq Au Quebec

Pdf Impact Of A Vaccine Passport On First Dose Covid 19 Vaccine Coverage By Age And Area Level Social Determinants In The Canadian Provinces Of Quebec And Ontario An Interrupted Time Series Analysis

Casino Privileges Loto Quebec

Calculateur De Taxes La Trousse De L Entrepreneur

Calameo Espace Montreal Volume 17 3

N 4456 Rapport D Information De Mm Regis Juanico Et Jacques Myard Depose En Application De L Article 146 3 Du Reglement Par Le Comite D Evaluation Et De Controle Des Politiques Publiques Sur L Evaluation

Taxes De Vente Tps Et Tvq Ppt Telecharger

Calculateur De Taxes La Trousse De L Entrepreneur

Quebec Sales Tax Gst Qst Calculator 2023 Wowa Ca

Calameo Edition Du 18 Janvier 2012